For customers using the Cashflows gateway

Cashflows AMS support

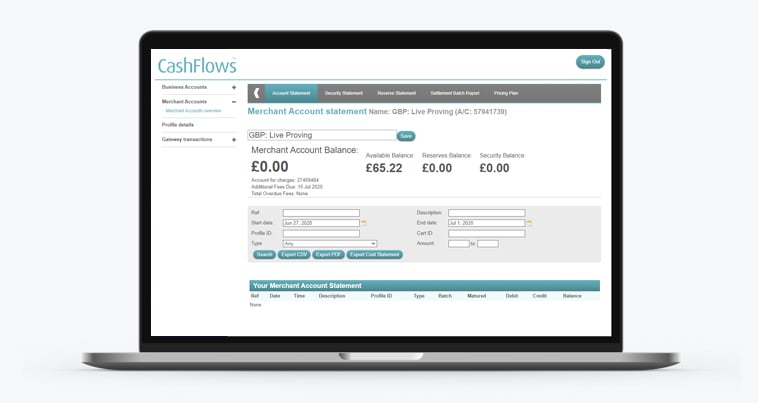

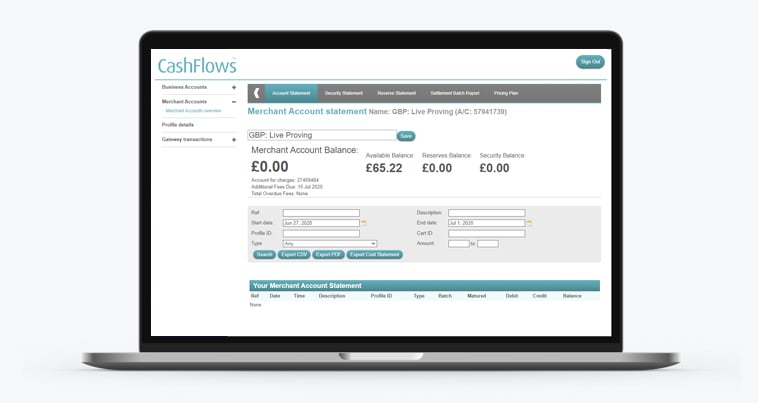

For customers using our Merchant Account Management System

Fast, secure, easy - card processing to support your business

All you need for taking card payments in person

Start taking payments online today

Take payments wherever your customers shop

Alternative business financing

Your industry supported with card payments

Fast, secure, easy - card processing to support your business

All you need for taking card payments in person

Start taking payments online today

Take payments wherever your customers shop

Alternative business financing

Your industry supported with card payments

For customers using our Merchant Account Management System