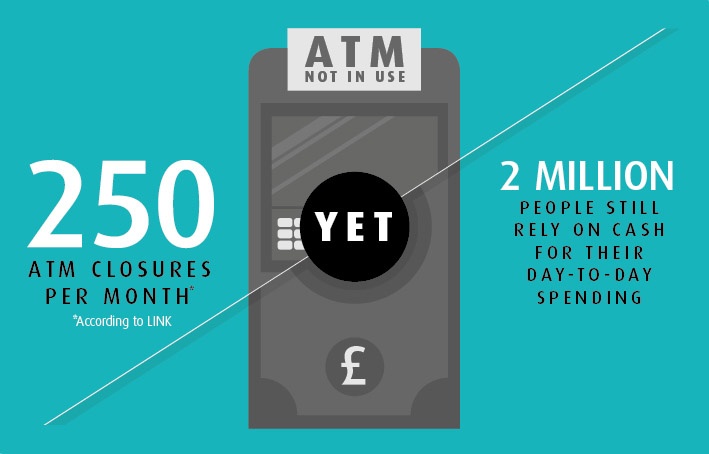

Recent news shows the closure of over 250 ATMs a month in the UK. Yet 2 million still rely on cash. Bad news? Or a potential opportunity for independant ATM deployers?

Network operator Link reports record ATM closures of over 250 per month - with 1,300 shut down over the 5 months leading up to the end of July. It's a move that has been criticised for neglecting the 2 million people who still rely on cash on a day-to-day basis.

But does this apparent bad news tell a good news story for potential Indpendent ATM Deployers - able to capitalize on the huge numbers of people that still rely on cash for their everyday spending, but are no longer served by the major banks?