ISV Payments Partnership

Partnering with Cashflows enables the businesses using your platform or services to accept payments simply, securely, and reliably, creating seamless customer experiences. Whether you build software or eCommerce systems for retailers, financial services, or other business types, we can help you to help your clients.

Speak to us today

03300244604

Monday to Friday, 9am to 5pm

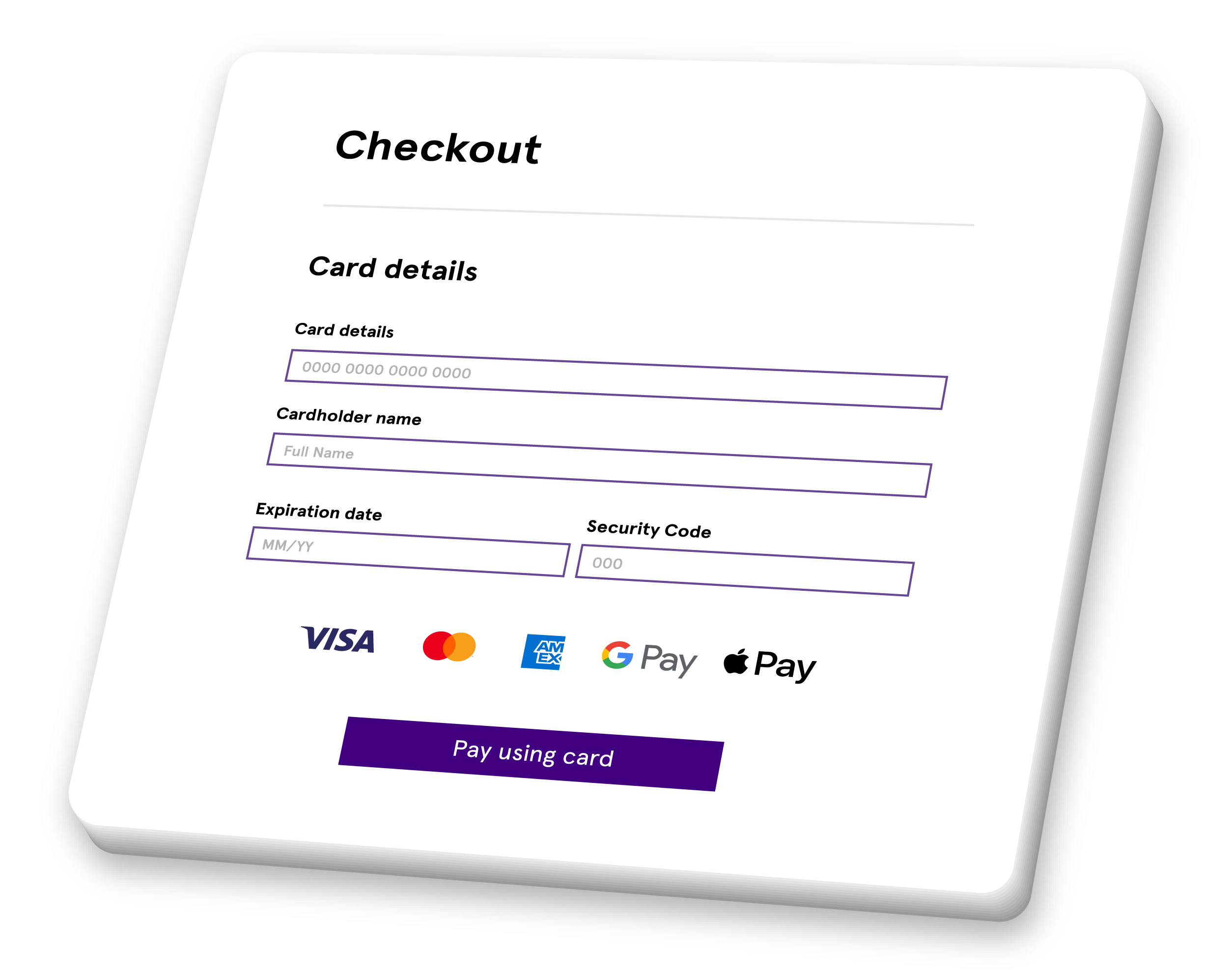

A payment gateway your merchants can trust

Our online payment gateway comes with everything your merchants need to reach more customers and deliver a seamless experience.

Easy to use, fully secure and completely customisable, this is hosted payments with a difference. With Apple Pay, Google Pay and PayPal as well as card, your merchants customers can pay how they like.

Easy payment integration with your software

We provide simple integrations through out rest APIs, providing a structured and consistent way using JavaScript Object Notation (JSON) for you to send requests to our payment gateway. Our API uses standard HTTP response codes and familiar verbs, ensuring development remains simple and consistent.

Partner focused

Dedicated relationship managers who will focus on growing your business and our relationship together. Plus flexible commercial models, designed to help you win more business.

Get customers set up rapidly with Fast Onboarding

With our Fast Onboarding tool, over 80% of customers are boarded within 24 hours of submitting an application.

Excellent Customer Service

Excellent Customer Service. We all know technology can sometimes be frustrating. At Cashflows, we pride ourselves on amazing customer service when it matters.

Interchange++ and blended pricing

Interchange++ and blended pricingWe offer a choice of pricing options, blended or Interchange ++. Different pricing models can help to win a wider-range of merchants – large and small.

Plug-ins with the industry’s big tech players

We’ve built partnerships with some of the most innovative companies. Help your customers integrate with platforms such as WooCommerce, BigCommerce, Magento and Opencart.

All major payment methods

All major payment methodsWe support all major payment methods including Visa, Mastercard, Apple Pay, and Google Pay so your merchants never miss a sale.

Enhance your payment processing experience with Cashflows

Cashflows solutions and services offer convenience and simplicity and are communicated in clear and accessible language with absolutely no jargon or payments speak. Our organisation and our people are ethical, friendly, and helpful at every interaction.

Businesses choose Cashflows for our collaborative, people-driven approach to relationships and our dedication to improving customer experience.

Your customers are in safe hands

We take great pride in looking after your customers with the same respect and care as you do, while always acknowledging their primary relationship with you as their software provider.

Our aim is to solve our customers' everyday problems, make their lives easier, and support them to achieve their business goals.

Some of our existing integrations include

"Cashflows worked with flexibility and dedication, collaborating closely to produce a payments solution that was perfect for our customers. We were fully supported as we moved to a new way of integrating and now have the payments tool to future-proof our business."

- Deputy Group Head of IT, Markerstudy Group

“Cashflows have been a preferred payment partner of floristPro websites for many years. We have been impressed with Cashflows' personal customer service and payment technology, which ensures our customers have reliable online payments - essential for any retailer and vital for the future.”

- Tim Teasel, Managing Director, floristPro

You choose how you want to partner

We can support you whether you want to refer your customers to us for payments provision, or to sell and own the payments element of your own customer offering.

FAQs

How do I qualify for this advance?

Through our partnership with Recap, we bring you Cashflows Advance. This advance is a pre-approved offering, based off your daily card revenue. We analyse your anonymous financial data and if you are eligible, you will be made an offer. Once you receive your offer (via email or text,) you will need to complete Recap’s quick and easy user journey to finalise your details and accept the funding. No additional paperwork or hassle.

Typically, you need to meet the following minimum criteria to be considered for an offer:

- You are an active business with healthy turnover.

- You’ve been trading for a minimum of 6 months.

- Your turnover is at least £1,500 per month.

What can I do with this advance?

That answer is simple; whatever you please. But in case you’re unsure, here are some ideas:

- Increase cash flow

- Renovate or expand your premises

- Purchase more stock

- Hire more staff

- Upgrade equipment

- Increase marketing activities

- Improve your website

- Expand the markets or sectors you are operating in

- As a credit facility

Do you require collateral?

No collateral is required. This is not like a normal bank loan; it is unrestricted and unsecured. Meaning that you do not have to pledge any assets to be eligible for this product.

What is collateral?

Collateral is an asset (something with value such as a house, car, jewellery) that a borrower pledges as security against a loan.

Why choose Cashflows Advance?

- This advance is offered through your already trusted platform, Cashflows

- You can receive the funding Same day or 24 hours

- Your advance is made to fit the needs of your business to help you scale, grow or secure your business

How are fees calculated?

The one-off fee is calculated depending on the advance amount and the estimated term, which are chosen during the application process.

Estimated Term – A “term” is the repayment period for a loan or other credit product.

Since your payments are linked to your sales (Remember, there are no fixed monthly payments!), your term will change (get longer or shorter) depending on how you trade. If you trade down for a month, and make less sales, you will pay back less, which means you will take longer to pay back the advance (increasing the term).

What is a pre-approved offer?

Each offer has already been calculated using anonymous financial data from Cashflows. This means that your offer is pretty much guaranteed. There will be no changes to your offer amount unless you would like to take a smaller advance or adjust your term during the application process.

Can I really get this advance in just a day or two?

Yes! Your advance could be in your account in as little as 24 hours!

Do you allow early settlements?

Yes, we do allow early settlements and merchants can receive a discount on the initial fee too. The majority of merchants prefer to keep their advance facility open and benefit from access to a revolving funding facility.

Do I pay interest?

No, the fee on the advance is calculated upfront as a percentage of the advance value. This fee is fixed and there are no hidden fees or extra costs.

Am I able to access more funding?

Once merchants obtain initial funding, the process of obtaining additional funding becomes even easier. Cashflows offers re-advances once a certain amount of the current advance has been paid back. As soon as your re-advance is available, you will be contacted.