The only flexible finance solution you need

Access to funding has never been this easy. Meet Cashflows Advance.

Instant cashflow to expand your business

Cashflows Advance is our new funding solution, provided by our partner, Recap. Together, we provide Cashflows merchants a convenient and flexible way to get quick access to capital, through the Cashflows platform.

It’s the fastest way to get funding. Cashflows merchants are pre-qualified through anonymous transaction data with 6 months trading. Recap conducts the KYC and KYB to approve the application, and a percentage of future sales is used to repay.

The advance is unrestricted, unsecured, and no interest is charged. Instead, we charge a one-off flat fee.

Once you have been approved, you will sign terms and conditions with Recap and financing will be provided by Recap.

Innovative, flexible funding is in

This hassle-free, transparent solution is made to be easy. With no interest rates or fixed monthly payments, and the freedom to use the advance for any business needs, this is the cutting-edge flexible funding option for businesses that need it.

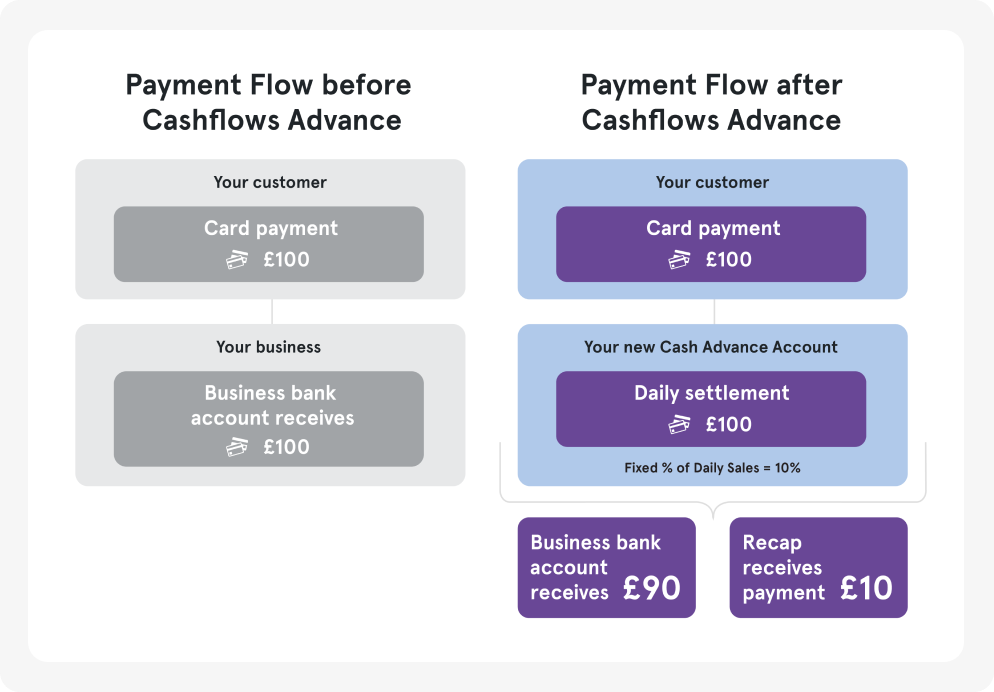

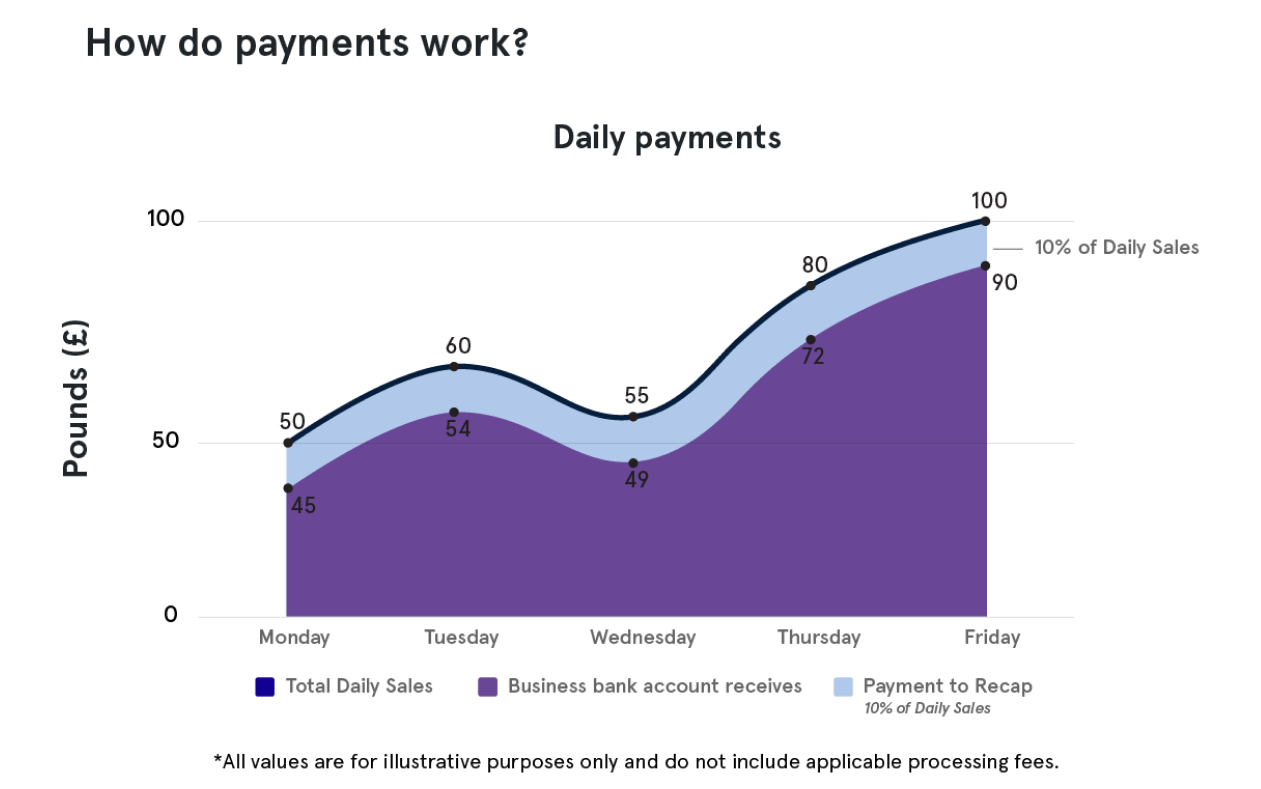

Repayments are simple and linked to sales revenue. So don’t worry too much when you are having a slow month, your repayments will be less.

Key features

Easy access to funding

No lengthy applications. No collateral required. No additional paperwork. We provide the anonymous financial data to Recap who create the offers and then we send them to you.

Cashflows merchants pre-approved

Merchants with a limited company are eligible with a minimum of 6 months trading; we use your daily card revenue to verify. The application is quick and easy.

No restrictions on funding

The advance is available to fund any business requirements you have. Expand, renovate, or hire more staff, the choice is up to you.

Flexible repayments

No interest, hidden costs, or fees. You pay as you earn which means less financial strain on your business. Earn less and you pay less. Earn more and you pay back the advance quicker.

Transparent fees

The one-off fee is calculated on the advance amount and the estimated term. You choose this during the application process.

Speedy funding

With Cashflows Advance you don’t need to wait to receive your funding. It can be received same day and, in some cases, the same afternoon that you have applied for Cashflows Advance.

"Cashflows offered us access to much-needed working capital, during a critical juncture for our business—a management buyout. From the initial contact to a swift resolution, the whole experience was remarkably straightforward. The team’s expertise and efficiency were evident as they guided us through the necessary steps, and the funds were made available the very next day."

- Founder, Easy Peasy Prizes

FAQs

How do I qualify for this advance?

Through our partnership with Recap, we bring you Cashflows Advance. This advance is a pre-qualified offering, based off your daily card revenue. We analyse your anonymous financial data, Recap conducts KYC/KYB to approve the application and then an offer will be made to you. Once you receive your offer (via email or text,) you will need to complete Recap’s quick and easy user journey to finalise your details and accept the funding. No additional paperwork or hassle.

Typically, you need to meet the following minimum criteria to be considered for an offer:

- You are an active limited company with healthy turnover.

- You have been trading with Cashflows for a minimum of 6 months.

- Your card turnover is at least £1,500 per month.

What can I do with this advance?

You can use this for any of your business needs. But in case you’re unsure, here are some ideas:

- Increase cash flow

- Renovate or expand your premises

- Purchase more stock

- Hire more staff

- Upgrade equipment

- Increase marketing activities

- Improve your website

- Expand the markets or sectors you are operating in

- As a credit facility

Do you require collateral?

No collateral is required. This is not like a normal bank loan; it is unrestricted and unsecured. This means that you do not have to pledge any assets to be eligible for this product.

What is collateral?

Collateral is an asset (something with value such as a house, car, jewellery) that a borrower pledges as security against a loan.

Why choose Cashflows Advance?

This advance is offered through your already trusted platform, Cashflows.

You can receive the funding same day or within 24 hours. Your advance is made to fit the needs of your business to help you scale, grow, or secure your business.

How are fees calculated?

The one-off fee is calculated depending on the advance amount and the estimated term, which are chosen during the application process.

Estimated Term – A “term” is the repayment period for a loan or other credit product.

Since your payments are linked to your sales (remember, there are no fixed monthly payments!), your term will change (get longer or shorter) depending on how you trade. If you trade down for a month, and make less sales, you will pay back less, which means you will take longer to pay back the advance (increasing the term).

What is a pre-qualified offer?

Each offer has already been calculated using anonymous financial data from Cashflows. There will be no changes to your offer amount unless you would like to take a smaller advance or adjust your term during the application process.

Do you allow early settlements?

Yes, we do allow early settlements and merchants can receive a discount on the initial fee too. However, most merchants prefer to keep their advance facility open and benefit from access to a revolving funding facility.

Do I pay interest?

No, the fee on the advance is calculated upfront as a percentage of the advance value. This fee is fixed and there are no hidden fees or extra costs.

Am I able to access more funding?

Once merchants obtain initial funding, the process of obtaining additional funding can become easier. Cashflows can offer a re-advance once a certain amount of the current advance has been paid back providing you still qualify. As soon as your re-advance is available, you will be contacted.

Who provides the funding?

Your financing will be provided by Retail Capital (UK) Ltd trading as Recap and as such you will sign terms and conditions (contract) with Recap.

Can I cancel the advance contract?

The contract period of the advance is agreed on upfront and the full advance must be repaid before you can exit your contract with Cashflows and Recap. If you choose to repay your advance before the contractual term ends, yes you can cancel.

Who do I contact for support for support with existing funding?

Contact Cashflows support for any enquiries: support@cashflows.com

Knowledge