Mobile Card Machine

The perfect card machine when you need to take card payments to the customer. This device is all you need to provide a simple and reliable payment experience in hospitality, some retail environments and more.

There's never been a better time to get in touch. Reduced monthly terminal fees up until April 2024. See details below.

Connect to your EPOS

Payments integrated with your EPOS system, for lightening the admin load and improving customer experience by reducing queue times.

Easy reporting

Manage your payments and get data insights from Cashflows Go, the online portal.

Connect all payments

The Countertop card machine is available as part of an omnichannel solution.

Secure payments

Fully PCI Compliant.

Key features

What can you expect from your Countertop card machine?

-

User experience

-

Customer service

-

Pricing

User experience

Accept all major payment types. Chip & PIN and contactless payments enabled

Accept ewallets (Apple Pay, Google Pay™️)

Printed receipts

Wifi & 4G enabled - major networks

Fast transaction speeds

Data reporting through Cashflows Go

Quick set up guide

Customer service

364-day support, 8am-11pm (Sunday 10am-5pm)

Next working-day swap out (when ordered before 4pm)

PCI compliance support

Pricing

£18 per month

Technical specifications

Dimensions: 170mm L x 78 mm W × 60 mm H

Display: 3.5” colour TFT LCD 320 x 480 pixels

Weight: 345 g

Battery: Li-ion 3100amH

Operating system: Linux OS

Hardware: 128 MB RAM, 32 bit Secure processor

Find the right card machine for your business

FAQs about card machines

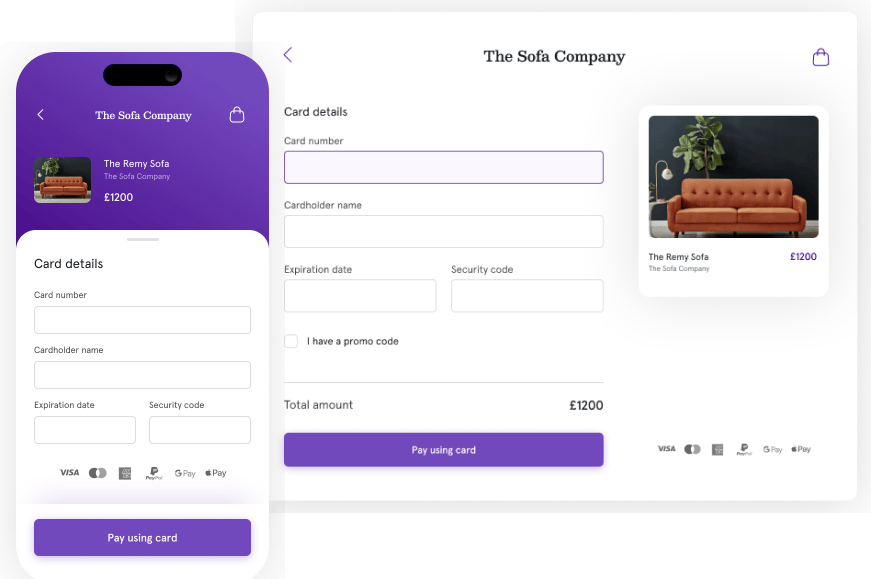

What is a Payment Gateway?

A payment gateway facilitates the authorisation of a debit or credit card or another online payment method for online businesses.

Cashflows payment gateway facilitates a transaction by the transfer of information between a website, mobile phone, or another merchant or partner API.

How long does it take to integrate?

This depends on a couple of things.

1) how complex the integration is from the merchant into our Payment Gateway and

2) how skilled the web developer is. Integration may be completed same day or may take a few weeks.

What are the requirements for integration?

Other than having a Cashflows merchant account, the requirements are for the integrator to be proficient in the necessary coding languages to integrate into APIs.

Is it RESTless?

Yes, the Cashflows Payment Gateway uses REST. We have a collection of resources and methods that can be used to help merchants with all aspects of the transaction’s lifecycle.

Is there a reporting platform and is it easily accessible?

Yes our Gateway comes with a reporting tool for monitoring, payments admin & reconciliation which is called Cashflows Portal. Cashflows Portal is included with our Payment Gateway as standard.

What plugins / open-source platforms do you support?

WooCommerce, Magento 2 and Open Cart.

What SaaS platforms do you connect with?

Big Commerce

When will I receive my funds?

Standard settlement terms are T+1 (Transaction + 1 day) - so typically next day.

For currency conversion this will be T+3 (Transaction + 3 days).

If you make use of our Anytime Settlement product, then you will receive the funds the same day as long as it’s not a weekend or a bank holiday.