Making payments easier, faster and more secure

Taking payments and accessing funds shouldn’t be complicated. You need a fast, reliable and secure payments solution that works for you and your customers.

As a merchant acquirer, our payments platform is designed for ultimate flexibility. Customers can choose how they want to pay. You’ll get your money the way you want it - fast and hassle-free.

And as your business grows, we’ll be there to support you all the way.

With the right tools, you can do great things

In payments, you need to get the basics right for your customers, so your business can thrive.

Provide all the payments methods your customers demand, access data in real time and get your funds delivered into your account in record time - our services make payments work for you.

Cashflows Anytime Settlement

No more waiting days to access funds from card payments. Get your money when you want it with our Anytime Settlement solution. Choose from three-day, next-day or even same-day settlement. Whatever suits you.

Say ‘yes’ to all payments

Say ‘yes’ to all payments

We support all major payment methods including Visa, Mastercard, American Express, Apple Pay, Google Pay, Click to Pay, PayPal or Samsung Pay, so you never miss a sale.

Secure payments

Secure payments

We take security seriously. The very best tech and authentication tools safeguard your business, secure your transactions and protect your customers. We'll help you become PCI compliant and we're one of the first acquirers to offer the benefits of 3D Secure Version 2.2.

Instore or online

Instore or online

Whether you’re taking payments online, in-person or in-app, we work with the leading partner gateways and are accredited for Ingenico and Castles card machines. Wherever your customers shop, we support payments everywhere.

Optimise acceptance rates

Optimise acceptance rates

Failed payments are frustrating for both you and your customers. Manage and optimise your acceptance rates with fast, easy access to your data.

Connect to us quickly

Connect to us quickly

Our APIs make integration easy. No heavy lifting, just what you need to get up and running.

Multi-currency payments

Multi-currency payments

We accept and settle payments in most major currencies. Enabling you to expand your market and grow your business.

Cashflows Account Updater

Automatically update lost, or stolen or expired customer card details. Ditch the lengthy, costly inconvenience of chasing updates by phone. It’s time your customers enjoyed seamless experiences, from start to finish.

Cashflows Direct Send

We don’t just help you get paid. We also make it quick, easy and safe for you to move money the other way. Delight payees with payout direct to card with our digital disbursements feature. Faster payments mean happy customers.

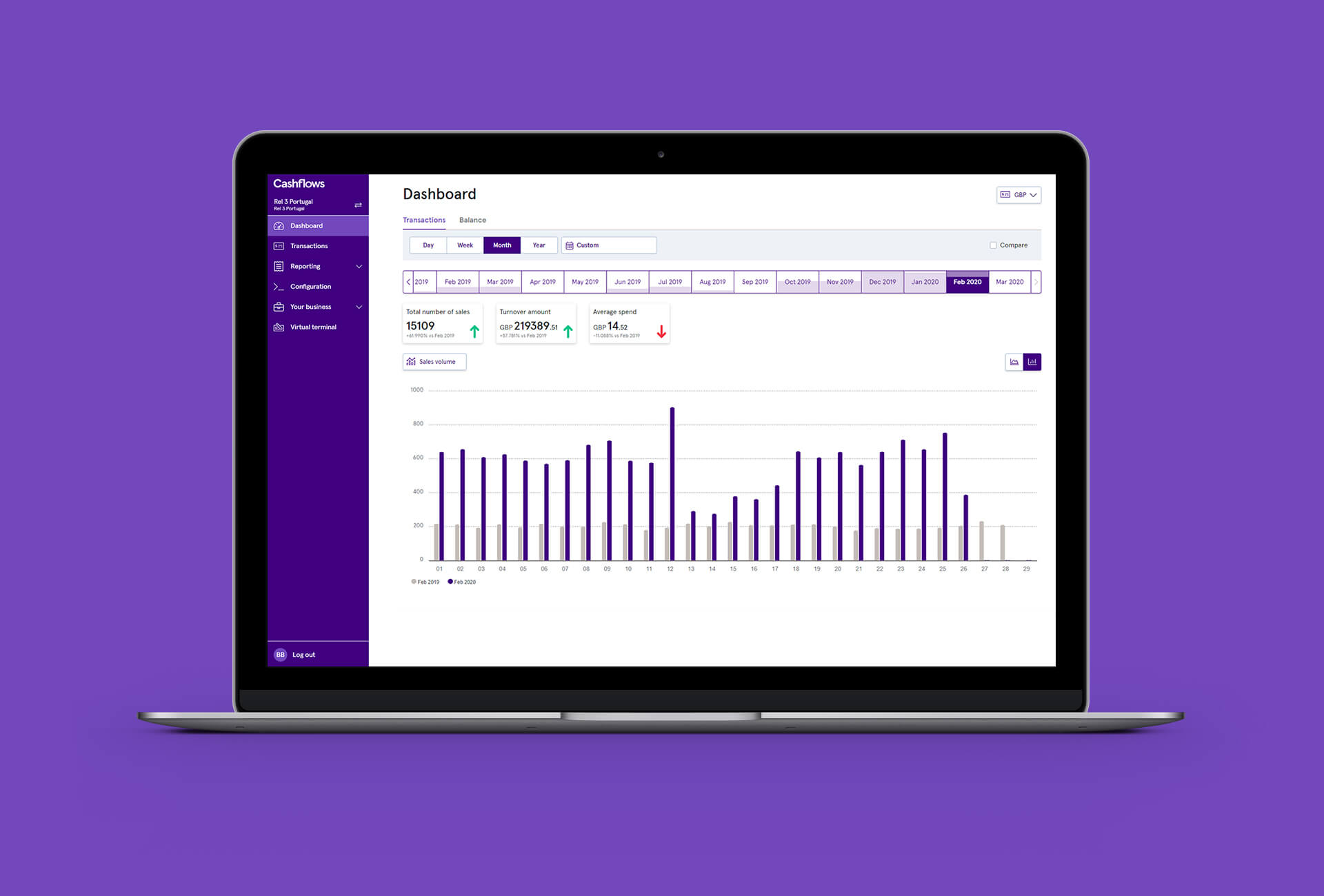

Real-time reporting

Wherever you are. Quick summary or nitty-gritty detail. Your online account lets you see your transactions in real-time, anytime. We put you in control.

Our reviews

Knowledge

Read our latest thoughts on taking control of your payment system